MEKA GLOBAL MAKINE

MEKAG

attach_money

Son Fiyat

47.42₺

trending_up

Günlük Değişim

1.89%

shopping_bag

Piyasa Değeri

2.96 Milyar

MEKA GLOBAL MAKINE Yorumu

Let's dive into the technical analysis of MEKAG (MEKA GLOBAL MAKINE) based on the provided data.

First of all, we can see that MEKAG is currently trading at 47.42, with a daily gain of 1.89%. The volume is also relatively high, indicating a decent market participation. From a technical standpoint, the Relative Strength Index (RSI) is at 69.63, which suggests that the stock is not yet overbought. The Stochastic Oscillator K and D lines are also supportive, with readings of 93.13 and 79.38, respectively.

Now, let's take a closer look at the pivot points. The main pivot point is at 44.73, which is relatively close to the current price. The resistance levels are at 47.27, 48.00, and 48.73, while the support levels are at 45.81, 45.08, and 44.35. These levels will be crucial in determining the short-term direction of the stock.

From a chart perspective, MEKAG is currently trading above its 20-day and 50-day moving averages, which is a bullish sign. The stock has also formed a higher low and a higher high in the recent past, indicating a potential uptrend.

Given these technical indicators, I would say that MEKAG has a bullish bias in the short term. The stock is likely to test the resistance level at 47.27, and if it manages to break above it, we could see a move towards 48.00. On the other hand, if the stock fails to break above 47.27, it may consolidate around the current levels or even retrace towards the support level at 45.81.

In conclusion, MEKAG looks like a buy opportunity in the short term, with a potential upside of around 2-3%. However, it's essential to keep an eye on the RSI and the Stochastic Oscillator to ensure that the stock doesn't become overbought. Additionally, it's always important to have a stop-loss in place to limit potential losses.

As a trader, I would consider buying MEKAG at current levels, with a target price of around 48.00 and a stop-loss at 45.50. Of course, this is just a personal opinion, and it's essential to do your own research and consider your own risk tolerance before making any investment decisions.

Overall, MEKAG looks like a promising opportunity in the short term, but it's crucial to stay vigilant and adapt to changing market conditions.

First of all, we can see that MEKAG is currently trading at 47.42, with a daily gain of 1.89%. The volume is also relatively high, indicating a decent market participation. From a technical standpoint, the Relative Strength Index (RSI) is at 69.63, which suggests that the stock is not yet overbought. The Stochastic Oscillator K and D lines are also supportive, with readings of 93.13 and 79.38, respectively.

Now, let's take a closer look at the pivot points. The main pivot point is at 44.73, which is relatively close to the current price. The resistance levels are at 47.27, 48.00, and 48.73, while the support levels are at 45.81, 45.08, and 44.35. These levels will be crucial in determining the short-term direction of the stock.

From a chart perspective, MEKAG is currently trading above its 20-day and 50-day moving averages, which is a bullish sign. The stock has also formed a higher low and a higher high in the recent past, indicating a potential uptrend.

Given these technical indicators, I would say that MEKAG has a bullish bias in the short term. The stock is likely to test the resistance level at 47.27, and if it manages to break above it, we could see a move towards 48.00. On the other hand, if the stock fails to break above 47.27, it may consolidate around the current levels or even retrace towards the support level at 45.81.

In conclusion, MEKAG looks like a buy opportunity in the short term, with a potential upside of around 2-3%. However, it's essential to keep an eye on the RSI and the Stochastic Oscillator to ensure that the stock doesn't become overbought. Additionally, it's always important to have a stop-loss in place to limit potential losses.

As a trader, I would consider buying MEKAG at current levels, with a target price of around 48.00 and a stop-loss at 45.50. Of course, this is just a personal opinion, and it's essential to do your own research and consider your own risk tolerance before making any investment decisions.

Overall, MEKAG looks like a promising opportunity in the short term, but it's crucial to stay vigilant and adapt to changing market conditions.

Fikirler

Benzer Hisseler

|

ASTOR ENERJI (ASTOR)

Son Fiyat - 104.50₺

|

arrow_forward |

|

TURK TRAKTOR (TTRAK)

Son Fiyat - 594.50₺

|

arrow_forward |

|

KALYON GUNES TEKNOLOJILERI (KLYPV)

Son Fiyat - 70.40₺

|

arrow_forward |

|

EGE ENDUSTRI (EGEEN)

Son Fiyat - 7947.50₺

|

arrow_forward |

|

EUROPOWER ENERJI (EUPWR)

Son Fiyat - 31.20₺

|

arrow_forward |

|

BOSCH FREN SISTEMLERI (BFREN)

Son Fiyat - 175.00₺

|

arrow_forward |

|

KALESERAMIK (KLSER)

Son Fiyat - 34.92₺

|

arrow_forward |

|

JANTSA JANT SANAYI (JANTS)

Son Fiyat - 22.30₺

|

arrow_forward |

|

TUMOSAN MOTOR VE TRAKTOR (TMSN)

Son Fiyat - 123.60₺

|

arrow_forward |

|

ULUSOY ELEKTRIK (ULUSE)

Son Fiyat - 215.10₺

|

arrow_forward |

|

BERA HOLDING (BERA)

Son Fiyat - 16.53₺

|

arrow_forward |

|

SARKUYSAN (SARKY)

Son Fiyat - 19.90₺

|

arrow_forward |

|

ALARKO CARRIER (ALCAR)

Son Fiyat - 999.50₺

|

arrow_forward |

|

KARSAN OTOMOTIV (KARSN)

Son Fiyat - 10.07₺

|

arrow_forward |

|

HATSAN GEMI (HATSN)

Son Fiyat - 44.46₺

|

arrow_forward |

|

BMS BIRLESIK METAL (BMSTL)

Son Fiyat - 57.35₺

|

arrow_forward |

|

EUROPEN ENDUSTRI (EUREN)

Son Fiyat - 7.10₺

|

arrow_forward |

|

KIMTEKS POLIURETAN (KMPUR)

Son Fiyat - 15.79₺

|

arrow_forward |

|

YIGIT AKU (YIGIT)

Son Fiyat - 25.70₺

|

arrow_forward |

|

KUZEY BORU (KBORU)

Son Fiyat - 12.94₺

|

arrow_forward |

|

GIPTA OFIS KIRTASIYE (GIPTA)

Son Fiyat - 122.00₺

|

arrow_forward |

|

OZATA DENIZCILIK (OZATD)

Son Fiyat - 231.00₺

|

arrow_forward |

|

DOKTAS DOKUMCULUK (DOKTA)

Son Fiyat - 24.36₺

|

arrow_forward |

|

TURK PRYSMIAN KABLO (PRKAB)

Son Fiyat - 34.72₺

|

arrow_forward |

|

KIRAC GALVANIZ (TCKRC)

Son Fiyat - 47.08₺

|

arrow_forward |

|

PARSAN (PARSN)

Son Fiyat - 92.15₺

|

arrow_forward |

|

EKOS TEKNOLOJI (EKOS)

Son Fiyat - 22.02₺

|

arrow_forward |

|

ALVES KABLO (ALVES)

Son Fiyat - 29.30₺

|

arrow_forward |

|

ISIK PLASTIK (ISKPL)

Son Fiyat - 37.30₺

|

arrow_forward |

|

F-M IZMIT PISTON (FMIZP)

Son Fiyat - 312.50₺

|

arrow_forward |

|

IZMIR FIRCA (IZFAS)

Son Fiyat - 185.00₺

|

arrow_forward |

|

BULBULOGLU VINC (BVSAN)

Son Fiyat - 103.00₺

|

arrow_forward |

|

INTEMA (INTEM)

Son Fiyat - 202.20₺

|

arrow_forward |

|

GENTAS (GENTS)

Son Fiyat - 23.86₺

|

arrow_forward |

|

SANICA ISI SANAYI (SNICA)

Son Fiyat - 4.66₺

|

arrow_forward |

|

SAY YENILENEBILIR ENERJI (SAYAS)

Son Fiyat - 57.00₺

|

arrow_forward |

|

USAK SERAMIK (USAK)

Son Fiyat - 4.84₺

|

arrow_forward |

|

MEKA GLOBAL MAKINE (MEKAG)

Son Fiyat - 47.42₺

|

arrow_forward |

|

EGE SERAMIK (EGSER)

Son Fiyat - 3.62₺

|

arrow_forward |

|

EMEK ELEKTRIK (EMKEL)

Son Fiyat - 83.10₺

|

arrow_forward |

|

SAFKAR EGE SOGUTMACILIK (SAFKR)

Son Fiyat - 110.20₺

|

arrow_forward |

|

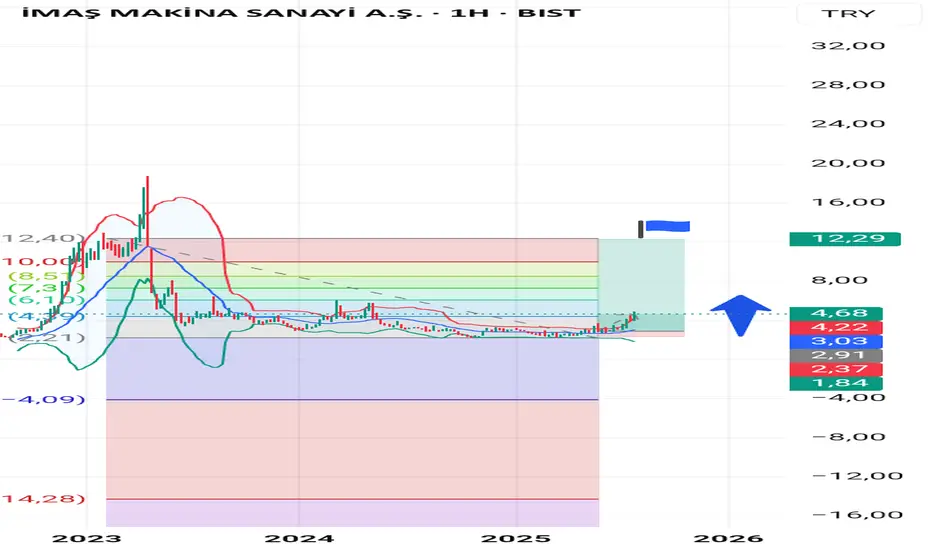

IMAS MAKINA (IMASM)

Son Fiyat - 4.68₺

|

arrow_forward |

|

KATMERCILER EKIPMAN (KATMR)

Son Fiyat - 2.70₺

|

arrow_forward |

|

GERSAN ELEKTRIK (GEREL)

Son Fiyat - 23.12₺

|

arrow_forward |

|

KLIMASAN KLIMA (KLMSN)

Son Fiyat - 26.94₺

|

arrow_forward |

|

HIDROPAR HAREKET KONTROL (HKTM)

Son Fiyat - 11.97₺

|

arrow_forward |

|

MANAS ENERJI YONETIMI (MANAS)

Son Fiyat - 10.83₺

|

arrow_forward |

|

AYES CELIK HASIR VE CIT (AYES)

Son Fiyat - 18.00₺

|

arrow_forward |

|

DEMISAS DOKUM (DMSAS)

Son Fiyat - 7.62₺

|

arrow_forward |

|

MAKINA TAKIM (MAKTK)

Son Fiyat - 17.59₺

|

arrow_forward |

|

DITAS DOGAN (DITAS)

Son Fiyat - 31.06₺

|

arrow_forward |

|

BMS CELIK HASIR (BMSCH)

Son Fiyat - 14.10₺

|

arrow_forward |

|

EGEPLAST (EPLAS)

Son Fiyat - 6.55₺

|

arrow_forward |

|

SILVERLINE ENDUSTRI (SILVR)

Son Fiyat - 23.96₺

|

arrow_forward |

|

BALATACILAR BALATACILIK (BALAT)

Son Fiyat - 67.50₺

|

arrow_forward |

|

BURCELIK VANA (BURVA)

Son Fiyat - 105.50₺

|

arrow_forward |

|

RAINBOW POLIKARBONAT (RNPOL)

Son Fiyat - 34.18₺

|

arrow_forward |

|

MAZHAR ZORLU HOLDING (MZHLD)

Son Fiyat - 6.69₺

|

arrow_forward |

|

SANEL MUHENDISLIK (SANEL)

Son Fiyat - 28.66₺

|

arrow_forward |

|

SERANIT GRANIT SERAMIK (SERNT)

Son Fiyat - 10.13₺

|

arrow_forward |

|

OZYASAR TEL (OZYSR)

Son Fiyat - 30.54₺

|

arrow_forward |

Hisse Sinyalleri

Hisse Sinyalleri