PEKER GMYO

PEKGY

attach_money

Son Fiyat

4.86₺

trending_down

Günlük Değişim

-9.83%

shopping_bag

Piyasa Değeri

24.30 Milyar

PEKER GMYO Yorumu

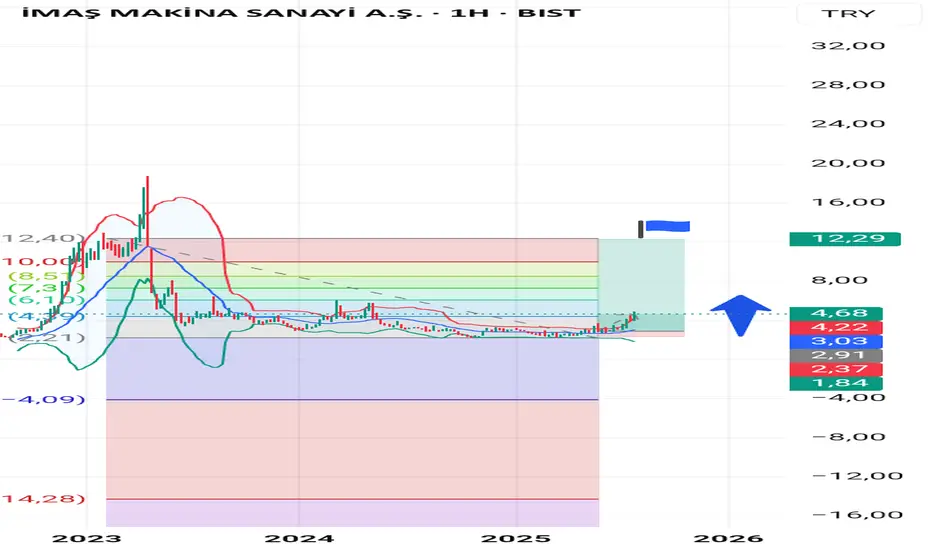

Let's dive into the technical analysis of the provided data.

**Hisse Senedi: PEKGY**

As we examine the data, we notice that the current closing price of PEKGY is 4.86, which has seen a significant decline of 9.83% in the recent period. This decline is accompanied by a relatively high trading volume, indicating significant market participation.

**Göreceli Hacim (Relative Volume)**

The relative volume stands at 1.279, which suggests that the trading activity is above average. This could be an indication of increased market interest, potentially leading to further price movements.

**Fiyatın Kazanç Oranı (Price-to-Earnings Ratio)**

The price-to-earnings ratio is 47.04, which appears relatively high compared to its peers. This might signify that investors are willing to pay a premium for each unit of earnings, indicating a higher degree of optimism.

**Seyreltilmiş EPS (Diluted EPS)**

The diluted EPS stands at -60.22, which is a concerning sign. This indicates that the company's profit margins are under pressure, and investors might be pricing in a potential decline in earnings.

**Net Borç (Net Debt)**

The net debt of 3,837,746,010 is a significant figure, which might impact the company's financial health and, subsequently, its stock performance.

**Teknik Derecelendirme (Technical Rating)**

The technical rating is "AL," suggesting a mixed outlook. However, we'll dive deeper into the technical indicators to gain a better understanding of the stock's trajectory.

**RSI (Relative Strength Index)**

The RSI stands at 78.70, indicating that the stock is trading in the overbought region. This could lead to a pullback or consolidation in the near term.

**Stokastik K ve D (Stochastic Oscillator)**

The Stochastic Oscillator's K-line is at 84.32, and the D-line is at 94.77. This suggests that the stock is in a strong upward trend, but the overbought condition might lead to a reversal.

** Pivot Noktaları (Pivot Points)**

The pivot points are as follows:

* Pivot M: 4.0267 * Pivot R1: 5.7649 * Pivot R2: 6.1398 * Pivot R3: 6.5147 * Pivot S1: 5.0151 * Pivot S2: 4.6402 * Pivot S3: 4.2652

These pivot points indicate potential resistance and support levels, which could influence the stock's trajectory.

**Tahmini Yön (Trend Prediction)**

Based on the technical indicators, I forecast a potential pullback or consolidation in the near term due to the overbought condition. However, if the stock manages to hold above the pivot M level (4.0267), we might see a continuation of the upward trend. A breakdown below the pivot S1 level (5.0151) could lead to further declines.

**Destek ve Direnç (Support and Resistance)**

The key support levels are 4.6402 (pivot S2) and 4.2652 (pivot S3). On the other hand, the resistance levels are 5.0151 (pivot S1), 5.7649 (pivot R1), and 6.1398 (pivot R2).

In conclusion, while the technical indicators suggest a mixed outlook, the overbought condition and potential profit-taking might lead to a pullback or consolidation in the near term. However, if the stock manages to hold above the pivot M level, we might see a continuation of the upward trend.

**Hisse Senedi: PEKGY**

As we examine the data, we notice that the current closing price of PEKGY is 4.86, which has seen a significant decline of 9.83% in the recent period. This decline is accompanied by a relatively high trading volume, indicating significant market participation.

**Göreceli Hacim (Relative Volume)**

The relative volume stands at 1.279, which suggests that the trading activity is above average. This could be an indication of increased market interest, potentially leading to further price movements.

**Fiyatın Kazanç Oranı (Price-to-Earnings Ratio)**

The price-to-earnings ratio is 47.04, which appears relatively high compared to its peers. This might signify that investors are willing to pay a premium for each unit of earnings, indicating a higher degree of optimism.

**Seyreltilmiş EPS (Diluted EPS)**

The diluted EPS stands at -60.22, which is a concerning sign. This indicates that the company's profit margins are under pressure, and investors might be pricing in a potential decline in earnings.

**Net Borç (Net Debt)**

The net debt of 3,837,746,010 is a significant figure, which might impact the company's financial health and, subsequently, its stock performance.

**Teknik Derecelendirme (Technical Rating)**

The technical rating is "AL," suggesting a mixed outlook. However, we'll dive deeper into the technical indicators to gain a better understanding of the stock's trajectory.

**RSI (Relative Strength Index)**

The RSI stands at 78.70, indicating that the stock is trading in the overbought region. This could lead to a pullback or consolidation in the near term.

**Stokastik K ve D (Stochastic Oscillator)**

The Stochastic Oscillator's K-line is at 84.32, and the D-line is at 94.77. This suggests that the stock is in a strong upward trend, but the overbought condition might lead to a reversal.

** Pivot Noktaları (Pivot Points)**

The pivot points are as follows:

* Pivot M: 4.0267 * Pivot R1: 5.7649 * Pivot R2: 6.1398 * Pivot R3: 6.5147 * Pivot S1: 5.0151 * Pivot S2: 4.6402 * Pivot S3: 4.2652

These pivot points indicate potential resistance and support levels, which could influence the stock's trajectory.

**Tahmini Yön (Trend Prediction)**

Based on the technical indicators, I forecast a potential pullback or consolidation in the near term due to the overbought condition. However, if the stock manages to hold above the pivot M level (4.0267), we might see a continuation of the upward trend. A breakdown below the pivot S1 level (5.0151) could lead to further declines.

**Destek ve Direnç (Support and Resistance)**

The key support levels are 4.6402 (pivot S2) and 4.2652 (pivot S3). On the other hand, the resistance levels are 5.0151 (pivot S1), 5.7649 (pivot R1), and 6.1398 (pivot R2).

In conclusion, while the technical indicators suggest a mixed outlook, the overbought condition and potential profit-taking might lead to a pullback or consolidation in the near term. However, if the stock manages to hold above the pivot M level, we might see a continuation of the upward trend.

Fikirler

Benzer Hisseler

|

QNB BANK (QNBTR)

Son Fiyat - 554.00₺

|

arrow_forward |

|

GARANTI BANKASI (GARAN)

Son Fiyat - 145.50₺

|

arrow_forward |

|

IS BANKASI (B) (ISBTR)

Son Fiyat - 455997.50₺

|

arrow_forward |

|

IS BANKASI (C) (ISCTR)

Son Fiyat - 14.93₺

|

arrow_forward |

|

AKBANK (AKBNK)

Son Fiyat - 66.55₺

|

arrow_forward |

|

VAKIFLAR BANKASI (VAKBN)

Son Fiyat - 28.86₺

|

arrow_forward |

|

YAPI VE KREDI BANK. (YKBNK)

Son Fiyat - 33.26₺

|

arrow_forward |

|

SABANCI HOLDING (SAHOL)

Son Fiyat - 95.20₺

|

arrow_forward |

|

T. HALK BANKASI (HALKB)

Son Fiyat - 28.18₺

|

arrow_forward |

|

TURKIYE SIGORTA (TURSG)

Son Fiyat - 10.34₺

|

arrow_forward |

|

ZIRAAT GMYO (ZRGYO)

Son Fiyat - 24.30₺

|

arrow_forward |

|

QNB FINANSAL KIRALAMA (QNBFK)

Son Fiyat - 58.55₺

|

arrow_forward |

|

T. KALKINMA BANK. (KLNMA)

Son Fiyat - 12.20₺

|

arrow_forward |

|

IS Y. MEN. DEG. (ISMEN)

Son Fiyat - 42.84₺

|

arrow_forward |

|

ANADOLU SIGORTA (ANSGR)

Son Fiyat - 99.35₺

|

arrow_forward |

|

RAY SIGORTA (RAYSG)

Son Fiyat - 267.50₺

|

arrow_forward |

|

TORUNLAR GMYO (TRGYO)

Son Fiyat - 72.45₺

|

arrow_forward |

|

EMLAK KONUT GMYO (EKGYO)

Son Fiyat - 20.10₺

|

arrow_forward |

|

INVESTCO HOLDING (INVES)

Son Fiyat - 362.00₺

|

arrow_forward |

|

ANADOLU HAYAT EMEK. (ANHYT)

Son Fiyat - 87.40₺

|

arrow_forward |

|

RONESANS GAYRIMENKUL YAT. (RGYAS)

Son Fiyat - 135.00₺

|

arrow_forward |

|

DESTEK FINANS FAKTORING (DSTKF)

Son Fiyat - 546.00₺

|

arrow_forward |

|

T.S.K.B. (TSKB)

Son Fiyat - 13.87₺

|

arrow_forward |

|

ALARKO HOLDING (ALARK)

Son Fiyat - 93.95₺

|

arrow_forward |

|

REYSAS GMYO (RYGYO)

Son Fiyat - 22.08₺

|

arrow_forward |

|

AGESA HAYAT EMEKLILIK (AGESA)

Son Fiyat - 170.50₺

|

arrow_forward |

|

AVRUPAKENT GMYO (AVPGY)

Son Fiyat - 66.90₺

|

arrow_forward |

|

LDR TURIZM (LIDER)

Son Fiyat - 225.80₺

|

arrow_forward |

|

ESCAR FILO (ESCAR)

Son Fiyat - 46.52₺

|

arrow_forward |

|

UFUK YATIRIM (UFUK)

Son Fiyat - 1122.00₺

|

arrow_forward |

|

ECZACIBASI YATIRIM (ECZYT)

Son Fiyat - 197.30₺

|

arrow_forward |

|

DAP GAYRIMENKUL (DAPGM)

Son Fiyat - 13.27₺

|

arrow_forward |

|

VERUSA HOLDING (VERUS)

Son Fiyat - 356.00₺

|

arrow_forward |

|

IS GMYO (ISGYO)

Son Fiyat - 18.61₺

|

arrow_forward |

|

AKIS GMYO (AKSGY)

Son Fiyat - 7.15₺

|

arrow_forward |

|

TUREKS TURIZM TASIMACILIK (TUREX)

Son Fiyat - 11.52₺

|

arrow_forward |

|

ALBARAKA TURK (ALBRK)

Son Fiyat - 9.20₺

|

arrow_forward |

|

YENI GIMAT GMYO (YGGYO)

Son Fiyat - 86.00₺

|

arrow_forward |

|

OZAK GMYO (OZKGY)

Son Fiyat - 13.27₺

|

arrow_forward |

|

BORLEASE OTOMOTIV (BORLS)

Son Fiyat - 19.36₺

|

arrow_forward |

|

TERA YATIRIM TEK. HOL. (PEHOL)

Son Fiyat - 17.81₺

|

arrow_forward |

|

DOGUS GMYO (DGGYO)

Son Fiyat - 36.62₺

|

arrow_forward |

|

SINPAS GMYO (SNGYO)

Son Fiyat - 4.47₺

|

arrow_forward |

|

AKSIGORTA (AKGRT)

Son Fiyat - 7.30₺

|

arrow_forward |

|

ICBC TURKEY BANK (ICBCT)

Son Fiyat - 15.46₺

|

arrow_forward |

|

KATILIMEVIM TAS. FIN. (KTLEV)

Son Fiyat - 9.45₺

|

arrow_forward |

|

HEDEF HOLDING (HEDEF)

Son Fiyat - 11.20₺

|

arrow_forward |

|

KUYAS YATIRIM (KUYAS)

Son Fiyat - 55.60₺

|

arrow_forward |

|

SERVET GMYO (SRVGY)

Son Fiyat - 3.25₺

|

arrow_forward |

|

HALK GMYO (HLGYO)

Son Fiyat - 3.88₺

|

arrow_forward |

|

GLOBAL YAT. HOLDING (GLYHO)

Son Fiyat - 9.24₺

|

arrow_forward |

|

SEKERBANK (SKBNK)

Son Fiyat - 5.79₺

|

arrow_forward |

|

OYAK YATIRIM MENKUL (OYYAT)

Son Fiyat - 37.68₺

|

arrow_forward |

|

GOZDE GIRISIM SERMAYESI YATIRIM ORT (GOZDE)

Son Fiyat - 21.20₺

|

arrow_forward |

|

IS FIN.KIR. (ISFIN)

Son Fiyat - 17.98₺

|

arrow_forward |

|

AKMERKEZ GMYO (AKMGY)

Son Fiyat - 209.50₺

|

arrow_forward |

|

ADRA GMYO (ADGYO)

Son Fiyat - 35.06₺

|

arrow_forward |

|

BATI EGE GMYO (BEGYO)

Son Fiyat - 12.38₺

|

arrow_forward |

|

AKFEN GMYO (AKFGY)

Son Fiyat - 2.92₺

|

arrow_forward |

|

ASCE GMYO (ASGYO)

Son Fiyat - 11.98₺

|

arrow_forward |

|

GARANTI FAKTORING (GARFA)

Son Fiyat - 26.20₺

|

arrow_forward |

|

VAKIF GMYO (VKGYO)

Son Fiyat - 2.72₺

|

arrow_forward |

|

INVEO YATIRIM HOLDING (INVEO)

Son Fiyat - 10.00₺

|

arrow_forward |

|

PASIFIK GMYO (PSGYO)

Son Fiyat - 2.72₺

|

arrow_forward |

|

VAKIF FIN. KIR. (VAKFN)

Son Fiyat - 3.16₺

|

arrow_forward |

|

SUR TATIL EVLERI GMYO (SURGY)

Son Fiyat - 59.00₺

|

arrow_forward |

|

KIZILBUK GYO (KZBGY)

Son Fiyat - 14.04₺

|

arrow_forward |

|

GELECEK VARLIK YONETIMI (GLCVY)

Son Fiyat - 71.00₺

|

arrow_forward |

|

KILER GMYO (KLGYO)

Son Fiyat - 6.01₺

|

arrow_forward |

|

TERA YATIRIM MENKUL DEGERLER (TERA)

Son Fiyat - 426.25₺

|

arrow_forward |

|

PANORA GMYO (PAGYO)

Son Fiyat - 73.20₺

|

arrow_forward |

|

ALARKO GMYO (ALGYO)

Son Fiyat - 21.54₺

|

arrow_forward |

|

GEDIK Y. MEN. DEG. (GEDIK)

Son Fiyat - 7.04₺

|

arrow_forward |

|

AHES GMYO (AHSGY)

Son Fiyat - 25.42₺

|

arrow_forward |

|

IHLAS HOLDING (IHLAS)

Son Fiyat - 2.71₺

|

arrow_forward |

|

PEKER GMYO (PEKGY)

Son Fiyat - 4.86₺

|

arrow_forward |

|

TSKB GMYO (TSGYO)

Son Fiyat - 7.13₺

|

arrow_forward |

|

KUZUGRUP GMYO (KZGYO)

Son Fiyat - 23.32₺

|

arrow_forward |

|

MHR GMYO (MHRGY)

Son Fiyat - 5.77₺

|

arrow_forward |

|

KORFEZ GMYO (KRGYO)

Son Fiyat - 3.43₺

|

arrow_forward |

|

SEKER GMYO (SEGYO)

Son Fiyat - 4.40₺

|

arrow_forward |

|

BIRIKIM VARLIK YONETIM (BRKVY)

Son Fiyat - 85.45₺

|

arrow_forward |

|

OSMANLI MENKUL (OSMEN)

Son Fiyat - 9.92₺

|

arrow_forward |

|

TURKER PROJE GAYRIMENKUL (TURGG)

Son Fiyat - 699.50₺

|

arrow_forward |

|

SEKER YATIRIM (SKYMD)

Son Fiyat - 16.30₺

|

arrow_forward |

|

DENIZ GMYO (DZGYO)

Son Fiyat - 7.20₺

|

arrow_forward |

|

A1 CAPITAL YATIRIM (A1CAP)

Son Fiyat - 9.55₺

|

arrow_forward |

|

KORAY GMYO (KGYO)

Son Fiyat - 3.60₺

|

arrow_forward |

|

MISTRAL GMYO (MSGYO)

Son Fiyat - 4.70₺

|

arrow_forward |

|

NUROL GMYO (NUGYO)

Son Fiyat - 11.03₺

|

arrow_forward |

|

VERA KONSEPT GMYO (VRGYO)

Son Fiyat - 3.81₺

|

arrow_forward |

|

UNLU YATIRIM HOLDING (UNLU)

Son Fiyat - 16.85₺

|

arrow_forward |

|

ULUSAL FAKTORING (ULUFA)

Son Fiyat - 3.94₺

|

arrow_forward |

|

INFO YATIRIM (INFO)

Son Fiyat - 3.83₺

|

arrow_forward |

|

ICU GIRISIM (ICUGS)

Son Fiyat - 3.80₺

|

arrow_forward |

|

ADESE GAYRIMENKUL (ADESE)

Son Fiyat - 15.49₺

|

arrow_forward |

|

IHLAS GAYRIMENKUL (IHLGM)

Son Fiyat - 2.78₺

|

arrow_forward |

|

ATAKULE GMYO (AGYO)

Son Fiyat - 7.31₺

|

arrow_forward |

|

EYG GMYO (EYGYO)

Son Fiyat - 2.69₺

|

arrow_forward |

|

LIDER FAKTORING (LIDFA)

Son Fiyat - 4.37₺

|

arrow_forward |

|

GULER YAT. HOLDING (GLRYH)

Son Fiyat - 4.84₺

|

arrow_forward |

|

MARTI GMYO (MRGYO)

Son Fiyat - 3.21₺

|

arrow_forward |

|

TREND GMYO (TDGYO)

Son Fiyat - 15.86₺

|

arrow_forward |

|

OZDERICI GMYO (OZGYO)

Son Fiyat - 9.17₺

|

arrow_forward |

|

YESIL GMYO (YGYO)

Son Fiyat - 6.30₺

|

arrow_forward |

|

EURO YATIRIM HOLDING (EUHOL)

Son Fiyat - 10.50₺

|

arrow_forward |

|

EDIP GAYRIMENKUL (EDIP)

Son Fiyat - 34.52₺

|

arrow_forward |

|

GLOBAL MEN. DEG. (GLBMD)

Son Fiyat - 12.70₺

|

arrow_forward |

|

HEDEF GIRISIM (HDFGS)

Son Fiyat - 2.43₺

|

arrow_forward |

|

PARDUS GIRISIM (PRDGS)

Son Fiyat - 7.55₺

|

arrow_forward |

|

DENGE HOLDING (DENGE)

Son Fiyat - 2.88₺

|

arrow_forward |

|

AVRASYA GMYO (AVGYO)

Son Fiyat - 10.00₺

|

arrow_forward |

|

SEKER FIN. KIR. (SEKFK)

Son Fiyat - 9.41₺

|

arrow_forward |

|

CREDITWEST FAKTORING (CRDFA)

Son Fiyat - 17.38₺

|

arrow_forward |

|

HUB GIRISIM (HUBVC)

Son Fiyat - 2.50₺

|

arrow_forward |

|

VAKIF YAT. ORT. (VKFYO)

Son Fiyat - 19.29₺

|

arrow_forward |

|

ATA GMYO (ATAGY)

Son Fiyat - 13.00₺

|

arrow_forward |

|

DAGI YATIRIM HOLDING (DAGHL)

Son Fiyat - 186.90₺

|

arrow_forward |

|

OYAK YAT. ORT. (OYAYO)

Son Fiyat - 31.58₺

|

arrow_forward |

|

IDEALIST GMYO (IDGYO)

Son Fiyat - 3.55₺

|

arrow_forward |

|

GARANTI YAT. ORT. (GRNYO)

Son Fiyat - 8.96₺

|

arrow_forward |

|

EURO KAPITAL YAT. ORT. (EUKYO)

Son Fiyat - 14.95₺

|

arrow_forward |

|

EURO YAT. ORT. (EUYO)

Son Fiyat - 12.17₺

|

arrow_forward |

|

EURO TREND YAT. ORT. (ETYAT)

Son Fiyat - 15.38₺

|

arrow_forward |

|

ENDA ENERJI HOLDING (ENDAE)

Son Fiyat - 19.11₺

|

arrow_forward |

|

SUMER VARLIK YONETIM (SMRVA)

Son Fiyat - 202.70₺

|

arrow_forward |

|

EGEYAPI AVRUPA GMYO (EGEGY)

Son Fiyat - 24.06₺

|

arrow_forward |

|

BULLS GSYO (BULGS)

Son Fiyat - 31.40₺

|

arrow_forward |

|

IS BANKASI (KUR.) (ISKUR)

Son Fiyat - 3179880.00₺

|

arrow_forward |

|

IS GIRISIM (ISGSY)

Son Fiyat - 42.10₺

|

arrow_forward |

|

VERUSATURK GIRISIM (VERTU)

Son Fiyat - 40.08₺

|

arrow_forward |

|

TERA YATIRIM TEK. HOL. (TEHOL)

Son Fiyat - 19.59₺

|

arrow_forward |

Hisse Sinyalleri

Hisse Sinyalleri