SODAS SODYUM SANAYII

SODSN

attach_money

Son Fiyat

102.00₺

trending_up

Günlük Değişim

0.20%

shopping_bag

Piyasa Değeri

1.53 Milyar

SODAS SODYUM SANAYII Yorumu

Let's dive into the technical analysis of SODSN (Soda Sanayi A.Ş.)!

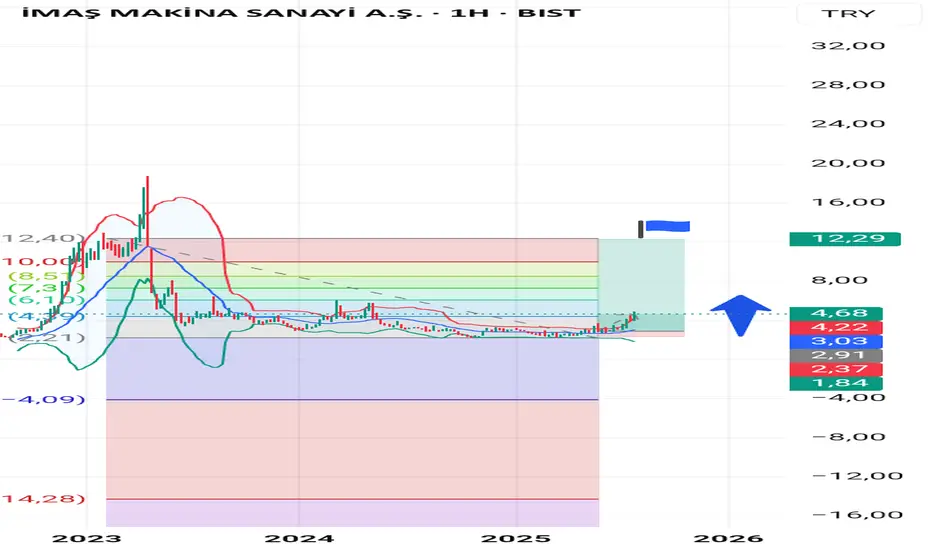

First of all, let's take a look at the current market mood. The RSI (Relative Strength Index) is at 56.72, which indicates a neutral zone. This means that the stock is not oversold or overbought, and it's in a stable region. However, we should keep in mind that the stochastic K and D indicators are at 33.06 and 47.49, respectively. This suggests that the stock is experiencing a slight decrease in momentum.

Now, let's talk about the price action. The current closing price is 102, which is above the 50-day moving average (100.70). This is a positive sign, as it indicates that the stock is trending upwards in the short-term. However, we should be cautious, as the stock is still below the 200-day moving average.

Looking at the pivot points, we see that the pivot median is at 100.70, and the resistance levels are at 103.62, 105.45, and 107.27. On the other hand, the support levels are at 99.98, 98.15, and 96.33. These levels will be crucial in determining the stock's future direction.

In terms of technical ratings, the stock has a "AL" rating, which indicates a strong buy signal. This is a positive sign, as it suggests that the stock has a high potential for growth.

Now, let's talk about the charts. The 50-day moving average is providing strong support, and the 20-day moving average is above it. This suggests that the short-term trend is upwards, and the stock is likely to continue its upward momentum.

Based on these indicators, I predict that the stock will continue to rise in the short-term, with a potential increase of 5-7%. However, we should be cautious, as the stock is still vulnerable to market volatility.

In conclusion, SODSN is a strong buy, with a high potential for growth. However, we should be aware of the potential risks and keep a close eye on the charts. As always, I recommend doing your own research and considering your own risk tolerance before making any investment decisions.

Bu analiz sonucuna göre, SODSN şu anda güçlü bir alım sinyali veriyor. Ancak, riskleri göz önünde bulundurarak, piyasa oynaklığına karşı dikkatli olalım. ¡Vamos a ver qué pasa!

First of all, let's take a look at the current market mood. The RSI (Relative Strength Index) is at 56.72, which indicates a neutral zone. This means that the stock is not oversold or overbought, and it's in a stable region. However, we should keep in mind that the stochastic K and D indicators are at 33.06 and 47.49, respectively. This suggests that the stock is experiencing a slight decrease in momentum.

Now, let's talk about the price action. The current closing price is 102, which is above the 50-day moving average (100.70). This is a positive sign, as it indicates that the stock is trending upwards in the short-term. However, we should be cautious, as the stock is still below the 200-day moving average.

Looking at the pivot points, we see that the pivot median is at 100.70, and the resistance levels are at 103.62, 105.45, and 107.27. On the other hand, the support levels are at 99.98, 98.15, and 96.33. These levels will be crucial in determining the stock's future direction.

In terms of technical ratings, the stock has a "AL" rating, which indicates a strong buy signal. This is a positive sign, as it suggests that the stock has a high potential for growth.

Now, let's talk about the charts. The 50-day moving average is providing strong support, and the 20-day moving average is above it. This suggests that the short-term trend is upwards, and the stock is likely to continue its upward momentum.

Based on these indicators, I predict that the stock will continue to rise in the short-term, with a potential increase of 5-7%. However, we should be cautious, as the stock is still vulnerable to market volatility.

In conclusion, SODSN is a strong buy, with a high potential for growth. However, we should be aware of the potential risks and keep a close eye on the charts. As always, I recommend doing your own research and considering your own risk tolerance before making any investment decisions.

Bu analiz sonucuna göre, SODSN şu anda güçlü bir alım sinyali veriyor. Ancak, riskleri göz önünde bulundurarak, piyasa oynaklığına karşı dikkatli olalım. ¡Vamos a ver qué pasa!

Fikirler

Benzer Hisseler

|

SASA POLYESTER (SASA)

Son Fiyat - 3.12₺

|

arrow_forward |

|

GUBRE FABRIK. (GUBRF)

Son Fiyat - 255.00₺

|

arrow_forward |

|

AKSA AKRILIK (AKSA)

Son Fiyat - 10.12₺

|

arrow_forward |

|

PETKIM (PETKM)

Son Fiyat - 17.27₺

|

arrow_forward |

|

HEKTAS (HEKTS)

Son Fiyat - 4.05₺

|

arrow_forward |

|

BANVIT (BANVT)

Son Fiyat - 226.20₺

|

arrow_forward |

|

POLITEKNIK METAL (POLTK)

Son Fiyat - 6707.50₺

|

arrow_forward |

|

MARSHALL (MRSHL)

Son Fiyat - 1463.00₺

|

arrow_forward |

|

KALEKIM KIMYEVI MADDELER (KLKIM)

Son Fiyat - 28.78₺

|

arrow_forward |

|

EGE PROFIL (EGPRO)

Son Fiyat - 21.74₺

|

arrow_forward |

|

KORDSA TEKNIK TEKSTIL (KORDS)

Son Fiyat - 61.30₺

|

arrow_forward |

|

YAPRAK SUT VE BESI CIFT. (YAPRK)

Son Fiyat - 342.25₺

|

arrow_forward |

|

YAYLA GIDA (YYLGD)

Son Fiyat - 10.72₺

|

arrow_forward |

|

POLISAN HOLDING (POLHO)

Son Fiyat - 4.09₺

|

arrow_forward |

|

BOSSA (BOSSA)

Son Fiyat - 6.87₺

|

arrow_forward |

|

KARTONSAN (KARTN)

Son Fiyat - 90.45₺

|

arrow_forward |

|

DYO BOYA (DYOBY)

Son Fiyat - 15.81₺

|

arrow_forward |

|

SANIFOAM ENDUSTRI (SANFM)

Son Fiyat - 20.50₺

|

arrow_forward |

|

TARKIM BITKI KORUMA (TARKM)

Son Fiyat - 377.00₺

|

arrow_forward |

|

SONMEZ PAMUKLU (SNPAM)

Son Fiyat - 34.06₺

|

arrow_forward |

|

KOZA POLYESTER (KOPOL)

Son Fiyat - 5.76₺

|

arrow_forward |

|

EGE GUBRE (EGGUB)

Son Fiyat - 101.90₺

|

arrow_forward |

|

MONDI TURKEY (MNDTR)

Son Fiyat - 6.54₺

|

arrow_forward |

|

SONMEZ FILAMENT (SONME)

Son Fiyat - 127.30₺

|

arrow_forward |

|

ALKIM KAGIT (ALKA)

Son Fiyat - 7.61₺

|

arrow_forward |

|

OFIS YEM GIDA (OFSYM)

Son Fiyat - 55.10₺

|

arrow_forward |

|

BOR SEKER (BORSK)

Son Fiyat - 24.42₺

|

arrow_forward |

|

KONYA KAGIT (KONKA)

Son Fiyat - 36.12₺

|

arrow_forward |

|

ISIKLAR ENERJI YAPI HOL. (IEYHO)

Son Fiyat - 12.94₺

|

arrow_forward |

|

ALKIM KIMYA (ALKIM)

Son Fiyat - 17.83₺

|

arrow_forward |

|

SOKE DEGIRMENCILIK (SOKE)

Son Fiyat - 11.89₺

|

arrow_forward |

|

ULUSOY UN SANAYI (ULUUN)

Son Fiyat - 7.85₺

|

arrow_forward |

|

BAREM AMBALAJ (BARMA)

Son Fiyat - 18.65₺

|

arrow_forward |

|

EKSUN GIDA (EKSUN)

Son Fiyat - 6.28₺

|

arrow_forward |

|

KAPLAMIN (KAPLM)

Son Fiyat - 210.30₺

|

arrow_forward |

|

AKIN TEKSTIL (ATEKS)

Son Fiyat - 80.50₺

|

arrow_forward |

|

ARSAN TEKSTIL (ARSAN)

Son Fiyat - 22.68₺

|

arrow_forward |

|

INNOSA TEKNOLOJI (INTEK)

Son Fiyat - 440.00₺

|

arrow_forward |

|

ISBIR SENTETIK DOKUMA (ISSEN)

Son Fiyat - 8.54₺

|

arrow_forward |

|

SANKO PAZARLAMA (SANKO)

Son Fiyat - 21.58₺

|

arrow_forward |

|

BAGFAS (BAGFS)

Son Fiyat - 39.90₺

|

arrow_forward |

|

DINAMIK ISI MAKINA YALITIM (DNISI)

Son Fiyat - 22.60₺

|

arrow_forward |

|

MERCAN KIMYA (MERCN)

Son Fiyat - 34.58₺

|

arrow_forward |

|

OTTO HOLDING (OTTO)

Son Fiyat - 497.00₺

|

arrow_forward |

|

YUNSA YUNLU (YUNSA)

Son Fiyat - 6.11₺

|

arrow_forward |

|

KUTAHYA SEKER FABRIKASI (KTSKR)

Son Fiyat - 68.65₺

|

arrow_forward |

|

ISBIR HOLDING (ISBIR)

Son Fiyat - 114.90₺

|

arrow_forward |

|

LUKS KADIFE (LUKSK)

Son Fiyat - 88.25₺

|

arrow_forward |

|

BAK AMBALAJ (BAKAB)

Son Fiyat - 37.02₺

|

arrow_forward |

|

OZSU BALIK (OZSUB)

Son Fiyat - 21.20₺

|

arrow_forward |

|

RUZY MADENCILIK VE ENERJI (ALMAD)

Son Fiyat - 7.25₺

|

arrow_forward |

|

EMINIS AMBALAJ (EMNIS)

Son Fiyat - 205.00₺

|

arrow_forward |

|

RUBENIS TEKSTIL (RUBNS)

Son Fiyat - 21.18₺

|

arrow_forward |

|

SUMAS SUNI TAHTA (SUMAS)

Son Fiyat - 318.00₺

|

arrow_forward |

|

DURAN DOGAN BASIM (DURDO)

Son Fiyat - 4.35₺

|

arrow_forward |

|

GEDIZ AMBALAJ (GEDZA)

Son Fiyat - 25.02₺

|

arrow_forward |

|

BILICI YATIRIM (BLCYT)

Son Fiyat - 20.86₺

|

arrow_forward |

|

SODAS SODYUM SANAYII (SODSN)

Son Fiyat - 102.00₺

|

arrow_forward |

|

BANTAS AMBALAJ (BNTAS)

Son Fiyat - 7.75₺

|

arrow_forward |

|

TEMAPOL POLIMER PLASTIK (TMPOL)

Son Fiyat - 83.55₺

|

arrow_forward |

|

HATAY TEKSTIL (HATEK)

Son Fiyat - 17.79₺

|

arrow_forward |

|

ACIPAYAM SELULOZ (ACSEL)

Son Fiyat - 111.00₺

|

arrow_forward |

|

KARSU TEKSTIL (KRTEK)

Son Fiyat - 26.48₺

|

arrow_forward |

|

SOKTAS (SKTAS)

Son Fiyat - 5.37₺

|

arrow_forward |

|

BERKOSAN YALITIM (BRKSN)

Son Fiyat - 7.62₺

|

arrow_forward |

|

MEGA POLIETILEN (MEGAP)

Son Fiyat - 4.80₺

|

arrow_forward |

|

OZERDEN AMBALAJ (OZRDN)

Son Fiyat - 9.08₺

|

arrow_forward |

|

SEKURO PLASTIK (SEKUR)

Son Fiyat - 16.93₺

|

arrow_forward |

|

PERGAMON DIS TICARET (PSDTC)

Son Fiyat - 128.20₺

|

arrow_forward |

|

EKIZ KIMYA (EKIZ)

Son Fiyat - 61.15₺

|

arrow_forward |

|

DIRITEKS DIRILIS TEKSTIL (DIRIT)

Son Fiyat - 26.46₺

|

arrow_forward |

|

BIRLIK MENSUCAT (BRMEN)

Son Fiyat - 8.60₺

|

arrow_forward |

|

BAHADIR KIMYA (BAHKM)

Son Fiyat - 53.35₺

|

arrow_forward |

|

RUZY MADENCILIK VE ENERJI (RUZYE)

Son Fiyat - 8.38₺

|

arrow_forward |

Hisse Sinyalleri

Hisse Sinyalleri